If you’re thinking of moving into a retirement village, there are lots of things to weigh up and money is one of the biggest considerations.

You’ll likely have lots of questions, not just about how much it will cost to move in but how much it will cost on an ongoing basis, and when it comes time to leave.

We understand you need certainty about your financial future, and that you might feel concerned about affordability and hidden costs. Let’s walk through each step of the process so you know exactly what to expect.

Payments – how much, when, and will they change over time?*

The most common types of agreement in RetireAustralia villages are leasehold and licence, where you purchase a long-term lease (usually 99 years) to live in your home. Here we break down the costs for leasehold and licence villages.

To increase financial certainty, we’ve made our contracts as clear and transparent as possible. We specify, upfront, which costs you’ll need to pay, and what they cover. Here’s a quick breakdown of the fees you’ll need to pay for the duration of your stay in one of our licence or leasehold villages:

* Please note, the costs are a little different for our freehold (strata title) villages in Sydney, New South Wales and in Logan, Queensland. It is also a little different for our community The Verge at Burleigh on the Gold Coast.

Entry payment

Your entry payment gives you the right to reside in your new home. The good news is that this is typically 70-80% of the local median housing price, making your move into a village more affordable and allowing you to maintain a healthy cash flow after the sale of your home.

You will not have to pay stamp duty on your unit, leaving you with extra money in your pocket to enjoy while you’re settling in.

Monthly service fees

Service fees depend on which village you choose, and are set at a cost-recovery rate only. These cover our operating costs as well as:

- Council rates

- Water rates

- Building insurance

- Building and garden maintenance

- 24-hour emergency call system

- Access to and upkeep of communal village facilities

By law, this fee is charged on a cost-recovery basis only and retirement village operators cannot profit from it. You can also rest assured that it can’t be increased greater than the Consumer Price Index without the approval of village residents. For further peace of mind, these fees are audited by an independent party each year.

Deferred Management Fee (DMF) *

What is the DMF?

The deferred management fee, or sometimes referred to as DMF, exit fee or departure fee, is payable when you leave the village and allows us to keep our entry prices as competitive as possible, leaving you with more cash in your pocket to enjoy life in the village after you move in.

It’s important to note that the DMF is the only charge that allows RetireAustralia to reinvest back into your village, through capital replacement works, maintenance of communal facilities, and village upgrades. This helps maintain value in your home and community, which is important when it comes time to sell.

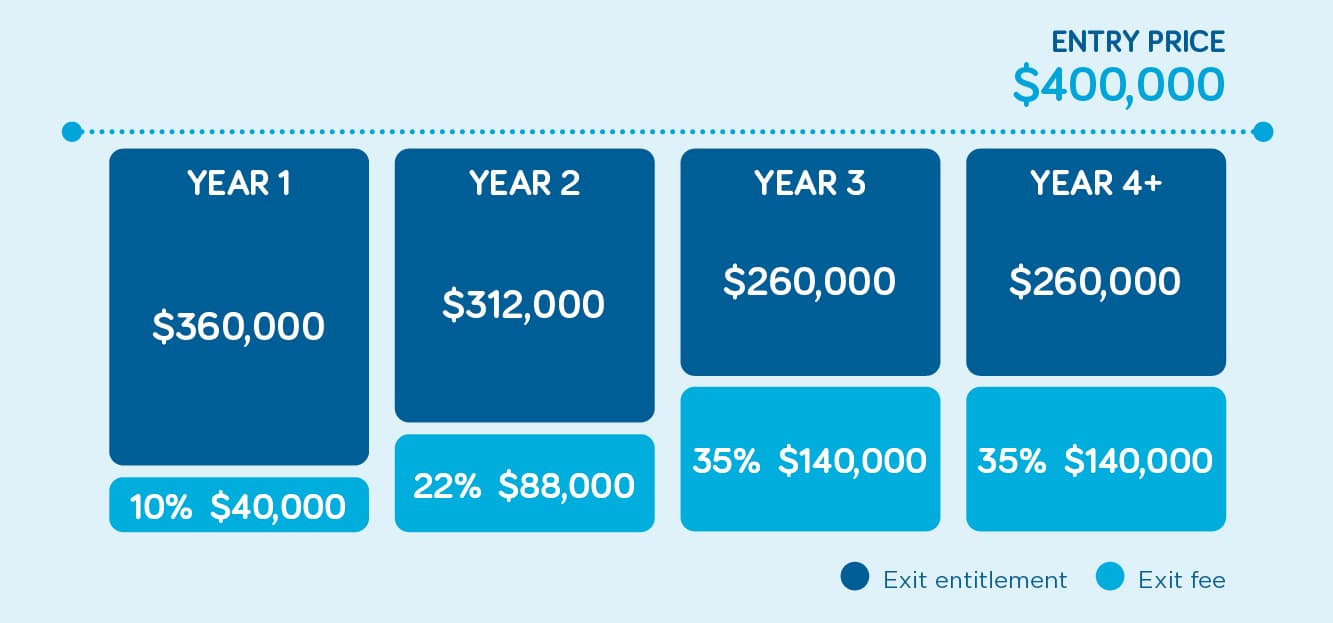

How is the DMF calculated?

When it comes time to leave the village, you’ll receive an exit entitlement, which is the purchase price minus the DMF. This fee is capped at 35% of your entry price and is stepped during your first three years in a village. There are no further increases after this period, no matter how long you stay.

From the day you move in, you’ll be able to calculate how much you will receive when you exit the village – making your future budgeting clear and predictable.

DMF example

To calculate your exit entitlement when leaving the village one would have to use the purchase price less the exit fee.*

* This is an example only. Additional charges may also be payable for any legal, registration or other applicable fees.

Please note, the DMF is a little different for our freehold (strata title) villages in Sydney, New South Wales and in Logan, Queensland. It is also a little different for our development The Verge at Burleigh on the Gold Coast.

What do I get for my money?

Our residents tell us that choosing to move into a retirement village is about far more than bricks and mortar. In reality, it’s an investment in you. You’ll be moving into a friendly community filled with people at the same stage of life, and you’ll have access to a range of amenities.

These vary depending on the village you choose but can include things like:

- Swimming pool

- Gymnasium

- Tennis court

- Bowling green

- Hair salon

- Community centre

- BBQ areas

- Residents’ bar

- Billiards room

- Library

You can also get involved in a range of interest groups, social activities and events from happy hour to mini-golf and more – it’s really up to you and the community.

What’s more, when you don’t need to worry about maintaining your house and garden, you’ll actually have time to explore new interests!

These intangible benefits are an important consideration, and should be weighed up alongside the financials. Moving into a retirement village is about so much more than the property. Residents tell us that the lifestyle, health and wellbeing benefits enhance their quality of life immeasurably.

What if my care needs change?

If your needs change, you can rest easy knowing you can access care and support if you need it. In RetireAustralia villages, you have a range of care and support services to choose from, whether that means ongoing daily support in a care apartment in many of our villages in New South Wales, South Australia and our new communities, or flexible care and support delivered in your home by our Home Care team or a provider of your choice. Care is tailored to your individual needs and funded privately or through access to an approved government funded Home Care Package (HCP).

How can I compare the cost of living in a retirement village with other options?

A true cost of living comparison can only be obtained by spending time with a sales consultant in a village, talking through your circumstances and needs, and understanding the fees and inclusions in your chosen village. You also need to do your own homework and make sure you have an accurate picture of your current living expenses to make the comparison valid.

In a general sense, retirement villages offer great cost of living value but trying to put a specific dollar figure to this comparison can easily become misleading. Your own cost of living and those applicable to villages can vary substantially, so it’s best to check with your village of choice directly.

On top of the hard costs listed above which village fees cover, the costs associated with living in a retirement village also provide residents with a sense of community and belonging, support from friends and staff, and numerous opportunities to lead a happy, active and healthy life.

Placing a value on these intangible benefits is very personal to each individual. To get more of an insight into what it is like to live in one of our retirement villages, take a look at our retirement stories and insights. Or read up on global research about the health benefits of retirement living.