The Australian housing market is booming, and with a forecasted slowdown in growth on the horizon experts say those looking to sell would be wise to do so soon.

In the first few months of 2021 property prices have soared and houses have been selling fast, with buyers competing over a shrinking pool of properties.

Driven by a combination of record low mortgage rates, improving economic conditions, government incentives and low advertised supply levels, Australia’s housing market is booming which means older Australians are finding it relatively easy to sell their property, while also achieving a high price. For many, now could be the perfect time to top-up their retirement funds, while also securing their future by downsizing into a new home.

But …. experts are predicting housing prices may have peaked, with modelling from Westpac’s Housing Boom Price Gain report showing growth is expected to slow from mid-year.

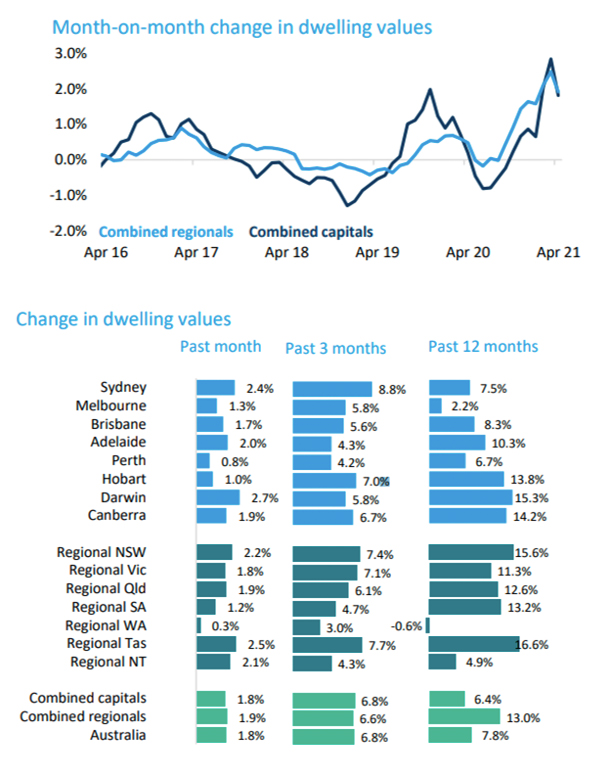

According to CoreLogic’s national home value index, Australian housing values lifted by 1.8% in April, easing from a 32-year high in March (2.8%). Tim Lawless, CoreLogic’s Research Director says, the pace of capital gains could slow further over the coming months.

Source: CoreLogic

If you’ve been thinking about retirement living, now could be the perfect time to make the move. Here’s four reasons why:

1. Housing supply anticipated to meet demand

Westpac says the surge in demand last year caught the market by surprise with many sellers deciding to hold off listing new properties until 2021. They are now ‘coming back strongly’ with new listings starting to play catch-up with demand.

A recent report from CoreLogic supports this with 26,470 newly advertised capital city properties being added to the market in the four weeks up 18 April. This is the largest number of new listings for this time of the year since 2016 and 17% above the five year average.

Along with more sellers entering the market, a significant lift in new building activity will gradually add properties to the market. According to CoreLogic, approvals for new dwelling construction are at record highs, and dwelling commencements over the December quarter were almost 20% higher than a year earlier and 5.5% above the decade average.

Westpac has also suggested that a dramatic slowing of Australia’s population growth, as migration stopped last year due to COVID-19, may become a problem in 2022 if national borders remain closed for much longer. With population growth slowing and new building projects ramping up, Westpac forecasts that supply may eventually exceed population-driven demand for houses, highlighting the need to move now for those who wish to take advantage of the current seller’s market.

2. Less incentives could impact housing demand

As Australia moves into a new phase of economic recovery with substantially less fiscal support, this could result in a reduction in housing market activity. Experts argue that housing demand may have been brought forward by incentives like the HomeBuilder grant and state based stamp duty concessions. As these incentives come to an end, alongside less migration and affordability constraints, it is possible that housing demand could be negatively impacted.

3. Soaring house prices predicted to become unaffordable

CoreLogic’s monthly nationwide real estate report confirmed that Australian median house prices increased 13.07%, from $568,833 in August 2020 to $643,203 in March 2021.

While this is great for sellers, Westpac is predicting the soaring house prices will start to discourage buyers, especially first home buyers. They are already reporting the early signs of a pull back with its ‘time to buy a dwelling’ index in its Consumer Sentiment Survey, down nearly 20% from its November high. Westpac says this index is particularly sensitive to affordability and has correctly picked every twist and turn in Australia’s housing market since the early 1970s.

Similarly, the daily update of CoreLogic’s benchmark measure of housing values, the Home Value Index, is showing a clear and broad based slowdown in the rate of housing value growth; a trend that has been evident since late March.

CoreLogic’s Tim Lawler says, “The slowdown in housing value appreciation is unsurprising given the rapid rate of growth seen over the past six months, especially in the context of subdued wages growth. With housing prices rising faster than incomes, it’s likely price sensitive sectors of the market, such as first home buyers and lower income households, are finding it harder to save for a deposit and transactional costs.”

4. Retirement living costs remain stable

While house prices have increased by 13% and units by 6.57% since the worst of COVID-19, retirement living properties have generally remained stable. In fact, they typically don’t keep pace with residential properties and are usually priced 20% below the local median house price.

Additionally, when you buy into a retirement village you don’t pay stamp duty, making the move more affordable and leaving you with more cash in your pocket (or super) after the sale of your home.

For Australians seeking financial certainty over exposure to capital gains and losses in their retirement years, buying a home in a retirement village offers peace of mind and clarity on exactly how much you will pay and how much you will ultimately get back. There is no need to worry about future downturns or market instability.

At the end of the day, timing is everything when deciding to move into a retirement village. The best case scenario is listing your home when the market is high and you’re not in a rush to sell. Conversely, you can wait a little too long and miss the market peak, or have health or other factors dictate when and how quickly you need to sell, which is not a situation anyone wants to find themselves in.

If you’re interested in taking another look at retirement living, please give us a call on 1300 687 738 and we can have a comprehensive discussion about your requirements to see if we can help you find a home that suits you.