If you’re thinking of moving into a retirement village, there are lots of things to weigh up and money is one of the biggest considerations.

You’ll likely have lots of questions, not just about how much it will cost to move in but how much it will cost on an ongoing basis, and when it comes time to leave.

We understand you need certainty about your financial future, and that you might feel concerned about affordability and hidden costs. Let’s walk through each step of the process so you know exactly what to expect.

Payments – how much, when, and will they change over time?*

The Green Tarragindi Retirement Village will operate under a leasehold agreement where residents purchase a long-term lease to live in their home. This is the most common types of agreement in RetireAustralia villages.

Our sales contract offers financial clarity, certainty and peace of mind. We specify, upfront, which costs you’ll need to pay, and what they cover. Here’s a quick breakdown of the fees you would need to pay for the duration of your stay in our brand-new leasehold community in Tarragindi.

Entry payment

Your entry payment gives you the right to reside in your new home on a long-term lease (usually 99 years).

Unlike most property transactions, you will not have to pay stamp duty on your apartment. This equates to a significant cost saving on entry.

General services charges

RetireAustralia makes no profit from village fees, which are charged on a cost-recovery basis and only increase in line with village costs.

Fees cover village operating costs including:

- Council and water rates

- Building insurance

- Building and garden maintenance

- 24-hour emergency call system

- Village staff

- Access to and upkeep of communal village facilities

For additional peace of mind, village finances are audited by an independent party each year.

Capped exit fee

The exit fee is payable when you leave the village and allows us to keep our entry prices as competitive as possible. This leaves you with more funds to enjoy life after you move into the village.

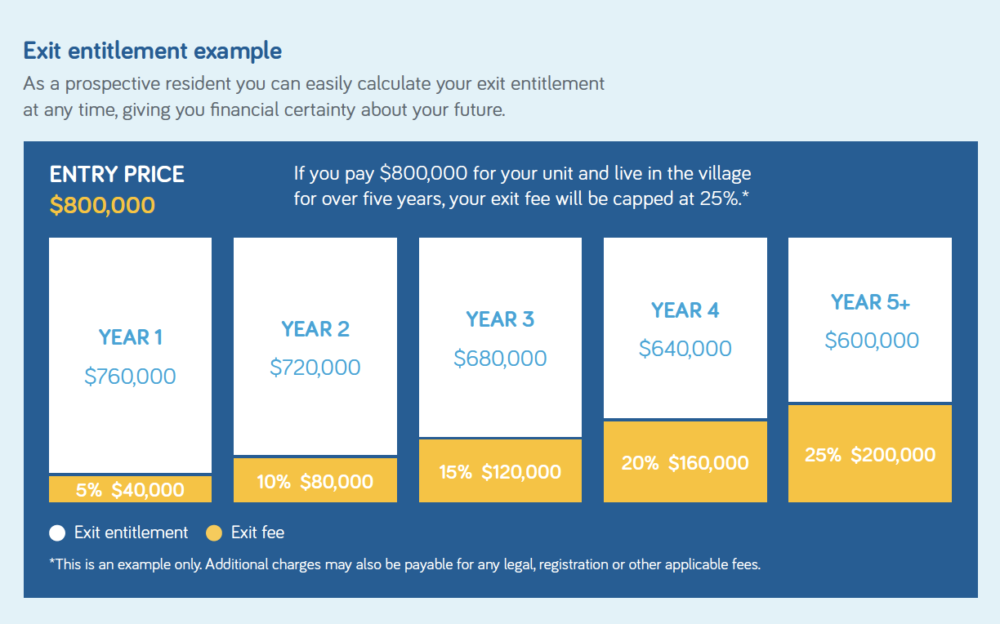

The exit fee is capped at 25% of your entry price and is stepped during your first five years in the village. There are no further increases after this period, no matter how long you stay. So from the day you move in, you’ll be able to calculate how much you will receive when you leave the village – making your future budgeting clear and predictable.

The fee is effectively an ‘enjoy now, pay later’ scheme, which helps reduce the cost of moving into a retirement village. It covers RetireAustralia’s initial investment in the village and helps to ensure that all residents have access to quality facilities and amenities while they’re living in the village. It funds capital replacement works and village upgrades.

Exit entitlement example

As a prospective resident you can easily calculate your exit entitlement at any time, giving you financial certainty about your future.

What do I get for my money?

Our residents tell us that choosing to move into a retirement village is about far more than bricks and mortar. In reality, it’s an investment in you. You’ll be moving into a friendly community filled with people at the same stage of life, and you’ll have access to a range of amenities.

At The Green Tarragindi, this includes things like:

- Community centre

- Resident bar, lounge and private dining room

- Championship grade bowling green

- Cinema

- Indoor and outdoor gyms

- Yoga lawns

- Workshop

- BBQ/ recreation area

- Gardens

- Library

- Consultation rooms for visiting health professionals

You can also get involved in a range of interest groups, social activities and events – it’s really up to you and the community.

What’s more, when you don’t need to worry about maintaining your home and garden, you’ll actually have time to explore new interests!

These intangible benefits are an important consideration, and should be weighed up alongside the financials. Moving into a retirement village is about so much more than the property. Residents tell us that the lifestyle, health and wellbeing benefits enhance their quality of life immeasurably.

What if I change my mind?

We want you to feel secure and confident with your decision to move into a RetireAustralia village, so our contract includes disclosure, cooling-off and settling-in periods.

After you receive a Disclosure Package, you have 21 days before you can enter into a contract. We recommend you use this time to get independent advice before you sign on the dotted line.

What’s more, should you change your mind within 14 days of signing your contract, we’ll refund your deposit in full.

Further to this, if you decide The Green Tarragindi isn’t right for you within 90 days of moving in, we’ll repay your entry payment minus any accrued service charges, any reasonable costs incurred for renovations made at your request, and a pro-rata rental fee for your time in the village.

What if my care needs change?

At The Green Tarragindi you’ll find comfort and belonging in our community where everyone looks out for each other. You’ll experience the care and support you need now and in the future—when life is going to plan, and when it’s full of the unexpected.

A professional home care team will be by your side, helping you to access care and connection to meet your changing needs—from assistance with personal care and daily tasks, to transport for appointments or basic clinical care. Plus the people who love you can also rest easy, knowing each resident has access to a PERS (Personal Emergency Response Service), should you need it.

Home care packages are tailored to your individual needs and funded privately or through access to an approved government funded Home Care Package (HCP). We can even help you to apply for HCP approval through My Aged Care.

How can I compare the cost of living in a retirement village with other options?

A true cost of living comparison can only be obtained by spending time with a sales consultant in a village, talking through your circumstances and needs, and understanding the fees and inclusions in your chosen village. You also need to do your own homework and make sure you have an accurate picture of your current living expenses to make the comparison valid.

In a general sense, retirement villages offer great cost of living value but trying to put a specific dollar figure to this comparison can easily become misleading. Your own cost of living and those applicable to villages can vary substantially, so it’s best to check with your village of choice directly.

On top of the hard costs listed above, which village fees cover, the costs associated with living in a retirement village also provide residents with a sense of community and belonging, support from friends and staff, and numerous opportunities to lead a happy, active and healthy life.

Placing a value on these intangible benefits is very personal to each individual. To get more of an insight into what it is like to live in one of our retirement villages, take a look at some of our resident stories. Or read up on global research about the health benefits of retirement living.

If you’d like peace of mind and clarity on the cost of your retirement home in years to come, take a closer look at The Green Tarragindi Retirement Village.